RBZ deploys teams nationwide to sell ZiG

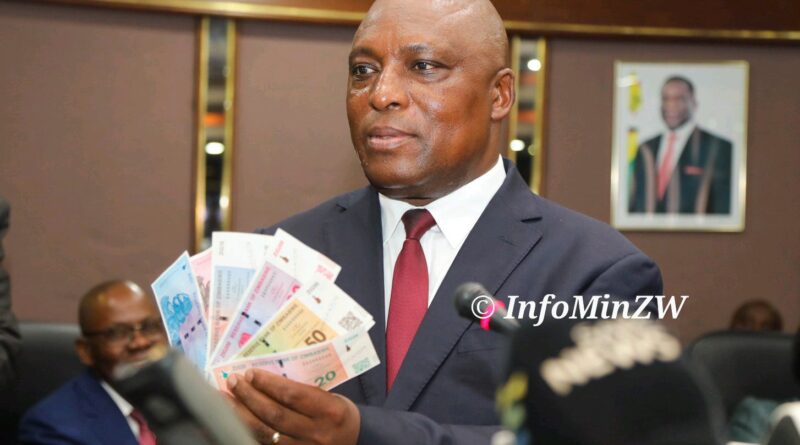

The Reserve Bank of Zimbabwe (RBZ) is intensifying its campaign of popularising the new structured currency, the Zimbabwe Gold (ZiG), with teams deployed across the country for the marketing drive.

This marketing drive by the central bank is meant to remove negative perceptions Zimbabweans have on the new currency.

The RBZ launched the new currency on April 5, which is said to have been backed by gold reserves held by the central bank.

However, the news of the new currency unsettled the market, with critics saying it won’t work.

They base their arguments on how previous currencies failed, saying the economic fundamentals were ignored.

Some Zimbabweans expressed dissatisfaction with the amount of gold declared by the RBZ in light of the recent announcement of a gold-backed structured currency.

Public figures like former cabinet minister Walter Mzembi are raised serious allegations of under-declaration and murky deals surrounding the country’s gold reserves.

This lack of transparency comes amidst the controversial moving of immediate past RBZ Governor John Mangudya to the helm of the Munhumutapa Sovereign Wealth Fund, before a full accounting of the gold reserves has been made public.

Mzembi questioned why Zimbabwe is selling its “national assets” while lacking proper local storage facilities for gold. He points to traditional gold storage centers like Switzerland and Dubai, while also mentioning Belarus, China, and other Middle Eastern markets as potential destinations for Zimbabwean gold.

“Today henceforth we should aspire to create local storage equivalent to colonial storage of our gold or where in modern day trade our gold is ending up, Belarus, Dubai, Switzerland, China and other Middle East markets. Why are we selling our family silverware and end up with nothing to show for it?

“Offshore Zimbabwean Gold Storage or Deals are where our real gold is and should be accounted for today and hereafter for the return of national confidence and trust. As of now it’s severely undermined,” Mzembi said.

ZiG was introduced with an initial rate of 13.56 to $1, replacing the Real Time Gross Settlement Dollar (RTGS), which had lost about 80% of its value this year and had been trading at 28,720 to $1 before the change.

The RTGS, also known as the Zimdollar , was launched in 2019 after a decade of dollarisation, which included so-called bond coins and bond notes, notionally pegged to the U.S. dollar and introduced in 2014 and 2016 respectively.

However, the Zimdollar struggled to gain trust and this year’s precipitous slide pushed annual inflation above 55% in March , raising fears of a return to the 2007-2009 era of hyperinflation under late former president Robert Mugabe.

“There was dire need for drastic change in the Zimbabwean monetary system,” Jacques Nel at research firm Oxford Economics was quoted by Reuters as having said.

The central bank statement on Friday correctly identified the most pressing problems, said Nel.

“A lack of credibility in both the domestic currency and the framework that governed it – but it is that same lack of credibility that casts doubt over the effectiveness of these new measures,” he added.

Zwnews