RBZ outlines de-dollarisation roadmap

RESERVE Bank of Zimbabwe (RBZ) Governor, Dr John Mushayavanhu has expressed optimism that the country’s de-dollarisation thrust will succeed, amid projections that the foreign currency black market that is notorious for fuelling exchange rate volatility, inflation and macro-economic stability will gradually die before 2030.

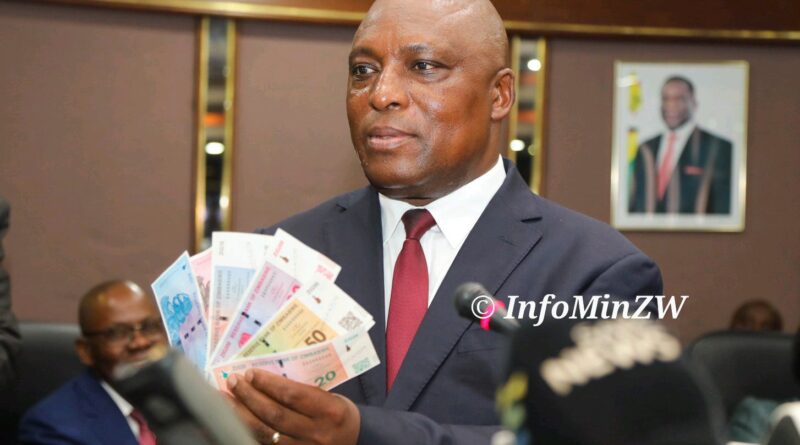

De-dollarisation is a process of moving away from the reliance on USD as the chief transacting currency to the newly introduced Zimbabwe Gold (ZiG). RBZ, a fortnight ago, unveiled ZiG as part of several policy measures to address exchange rate volatility, curtail inflation and restore macro-economic stability in the country. ZiG will circulate alongside a basket of other currencies, and the public has up to April 30 to convert their Zimbabwe dollars to the new currency.

ZiG’s value will be secured by both the quantity and worth of gold and other precious metals, along with foreign currency reserves.

Fielding questions during a Zimbabwe National Chamber of Commerce (ZNCC) breakfast meeting held in Mutare last week Thursday, Dr Mushayavanhu said currently 80 percent of transactions in the country are being done in USD, but the gradual de-dollarisation process will see the margins being reduced on year-to-year basis.